How business owners can manage their quarterly tax estimates with alternative lending solutions

By Abigail Czinege – VP of Operations, Kompass Funding

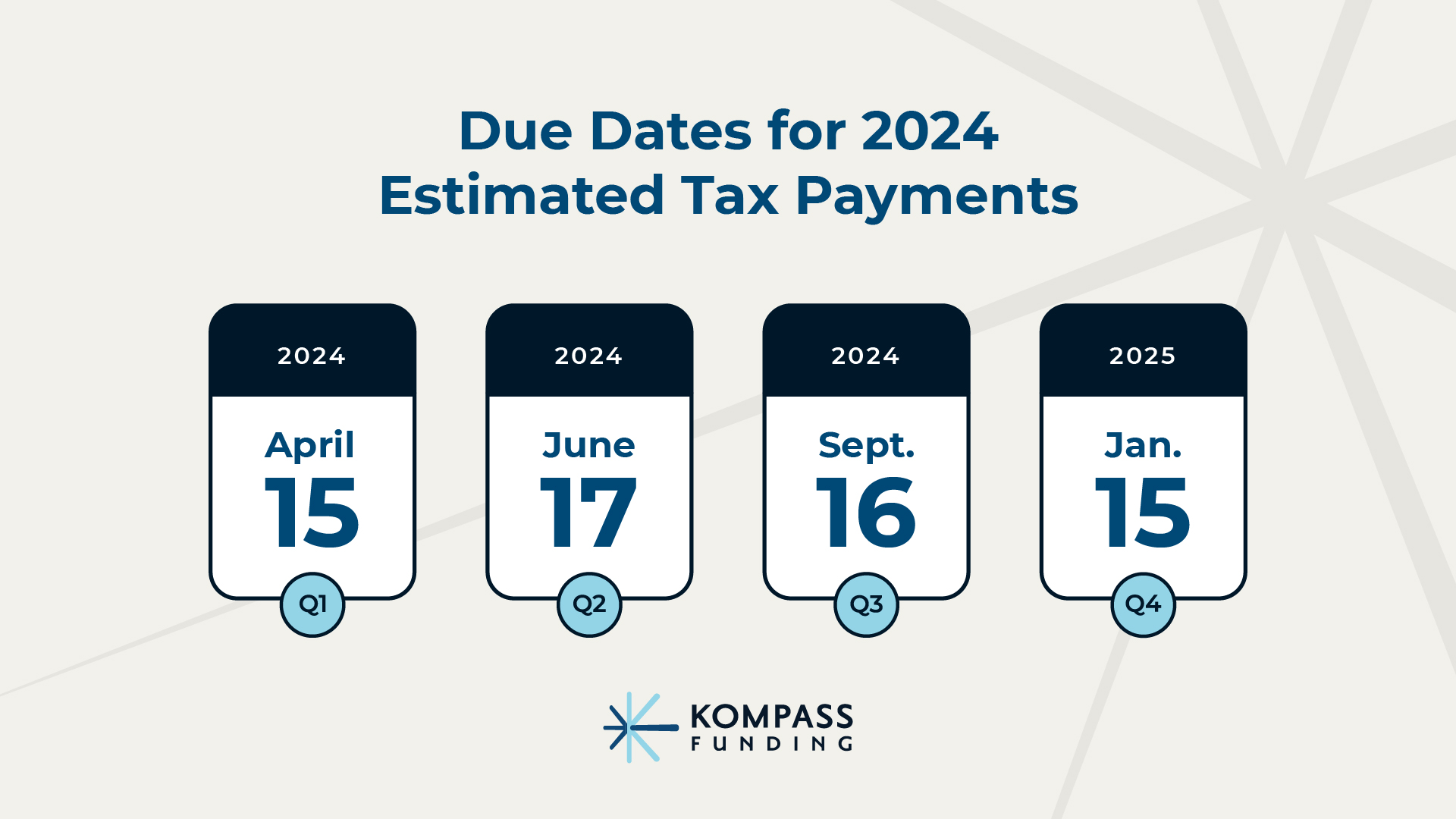

One pain point for many business owners is quarterly tax estimate payments – this includes sole proprietors, partners in partnerships, members of LLCs, and shareholders of S-corps. Because of the requirement to pay your quarterly estimates by April 15th, June 15th, September 15th, and January 15th (for the fourth quarter), many entrepreneurs find the complexities of taxes overwhelming. The good news is that there are proactive steps you can take to ease the burden, and one effective strategy is to utilize alternative lending solutions so that you have the necessary funds to meet your tax obligations without disrupting your cash flow.

Quarterly Tax Estimates

Estimating and managing your quarterly payments can be challenging considering fluctuating income, unexpected expenses, and seasonal variations in revenue can all impact your ability to accurately predict your tax liability. This unpredictability can lead to cash flow issues, making it difficult to set aside funds for tax payments.

That’s where short-term loans or factoring accounts receivable can be very beneficial. With extra cash on your balance sheet, owners can overcome the temporary cash flow challenge or unexpected tax liabilities.

Leveraging Accounts Receivable

Owners may also consider leveraging their accounts receivable for access to immediate funds through a factoring program. Factoring is not considered debt and therefore does not impact your balance sheet.

Reduced Risk of Bad Debts: Factoring can help mitigate the risk of bad debts by transferring the responsibility of collecting payments from customers to the factoring company. This can be particularly beneficial for businesses operating in industries with extended payment terms or dealing with customers who have a history of late payments or defaults. By outsourcing credit risk management, business owners can focus on core operations while ensuring a more predictable cash flow.

Access to Working Capital Without Debt: Factoring provides access to working capital without incurring debt. Unlike traditional loans or lines of credit, factoring does not create liabilities on the balance sheet since it involves the sale of accounts receivable rather than borrowing against them. This can be advantageous for businesses that may not qualify for traditional financing or prefer to avoid additional debt obligations. Additionally, factoring arrangements are typically structured based on the creditworthiness of the business’s customers, making them accessible to businesses with varying credit profiles.

Short-term loans

Short-term alternative lenders are typically faster and are a more flexible financing option than traditional banks. Here’s how business owners benefit from this solution.

Cash Flow Management: Fluctuations in cash flow are a reality for most business owners, especially around tax payment deadlines. Short-term loans can provide the necessary funds to cover tax obligations without disrupting regular operations or dipping into essential reserves. By securing a short-term loan, you can meet your tax obligations on time, avoiding costly penalties or interest charges for late payments.

Capital for Growth Opportunities: Sometimes, lucrative opportunities arise that require immediate capital infusion like purchasing inventory at a discounted rate or investing in marketing campaigns to capitalize on seasonal trends. Short-term loans can provide the necessary funds to seize these opportunities without delay. By leveraging short-term financing for growth initiatives, you can potentially increase your revenue and profitability, ultimately offsetting the cost of the loan.

Credit Building: Responsibly managing short-term loans can also help business owners build their credit profiles. Timely repayment of these loans demonstrates reliability and creditworthiness to lenders, which can be advantageous when seeking larger financing options in the future, such as long-term loans or lines of credit. A strong credit history opens doors to more favorable terms and higher borrowing limits, empowering business owners to access the capital they need to fuel expansion and achieve their long-term goals.

When it comes to managing your quarterly tax payments, alternative lending solutions can be invaluable. By accessing financing options tailored to the needs of small businesses, you can have the liquidity required to meet your quarterly tax obligations on time. Alternative lenders offer a variety of products, including lines of credit, short-term loans, and invoice financing, which can provide the flexibility and quick access to funds needed to cover your tax payments.

If you are a business owner and approaching your quarterly tax payments, now is the time to consider partnering with an alternative lender or factoring provider. Learn more about how to choose the right lender for tips on selecting the financial partner your business needs to grow.