How business owners can manage their quarterly tax estimates with alternative lending solutions

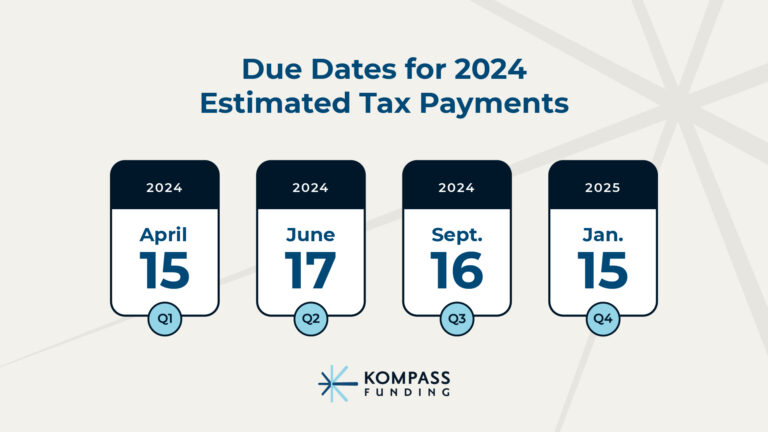

One pain point for many business owners is quarterly tax estimate payments – this includes sole proprietors, partners in partnerships, members of LLCs, and shareholders of S-corps. Because of the requirement to pay your quarterly estimates by April 15th, June 15th, September 15th, and January 15th (for the fourth quarter), many entrepreneurs find the complexities of taxes overwhelming. The good news is that there are proactive steps you can take to ease the burden, and one effective strategy is to utilize alternative lending solutions so that you have the necessary funds to meet your tax obligations without disrupting your cash flow.